R&P Tax Alert: The Solidarity levy – What does it mean for your company?

On January 15 2021, the Suriname parliament approved the proposed amendment laws of the Wage Tax Act and the Income Tax Act 1922 regarding the introduction of a solidarity tax. As a result of Suriname's deteriorated financial position, the government has chosen to introduce a solidarity levy.

General

The purpose of this solidarity tax is to get the problems related to the financing of Suriname’s budget deficit under control. By introducing this levy, the idea is to increase the income of the state for a period specified by law.

The starting date of the solidarity levy is February 1, 2021. This measure is temporary in nature and will apply until December 31, 2021.

On the basis of the approved amendment laws, the solidarity tax will be levied on the following sources of income for individuals:

- income from work;

- income from real estate

- income from movable capital;

- profit from business.

In addition, entities, including, for example, limited companies or in principle branches of foreign companies, will also pay the solidarity levy.

1. Natuurlijke Employees

Normal salary

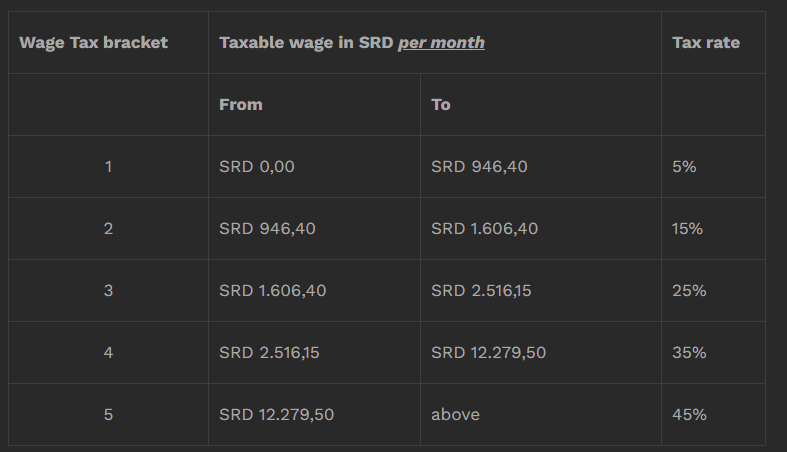

With the introduction of the solidarity tax, the tax brackets for employees (income from work) will be as followed:

Employees whose taxable wage is less than SRD 12,500 per month, the introduction of the solidarity levy has no effect. If employees earn more than SRD 12,500, they will pay the solidarity levy. For example, someone with a taxable wage of SRD 15,000 per month will pay an estimated of SRD 189.- per month in solidarity levy.

Lump sum payment

Employees who receive lump sum payments from their employer will also pay the solidarity levy on lump sum.

The tax brackets for lump sum payments are as follows:

Overtime pay

The solidarity levy is not levied on overtime pay.

2. Natuurlijke Other individuals

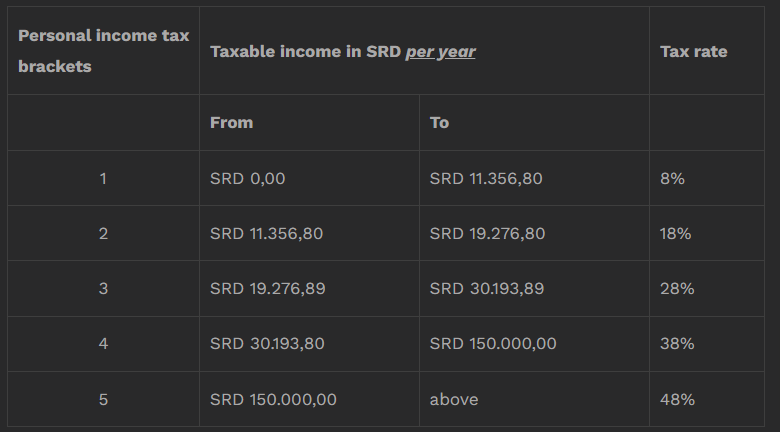

Individuals who have a sole proprietorship or, for example, individuals who receive income from the rental of real estate, are liable for (personal) income tax and will also pay the solidarity levy. The tax brackets on an annual basis are as follows:

3. Entities

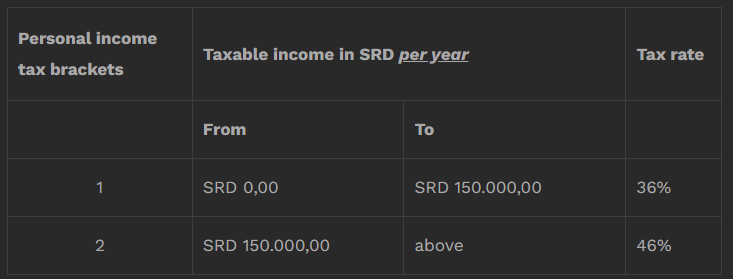

Entities are liable for corporate income tax. With the introduction of the solidarity tax, the tax brackets for the corporate income taxation of entities will be as follows:

If you have any questions regarding the solidarity tax and if you would like to know what the effect of this tax will be for your company, please feel free to contact us.

January 16th, 2021

|Nieuws

Tax Alert

Wet- en Regelgeving

Deel dit artikel